CALENDARIO DOMÉSTICO DE EMISIONES PRIMER SEMESTRE 2024

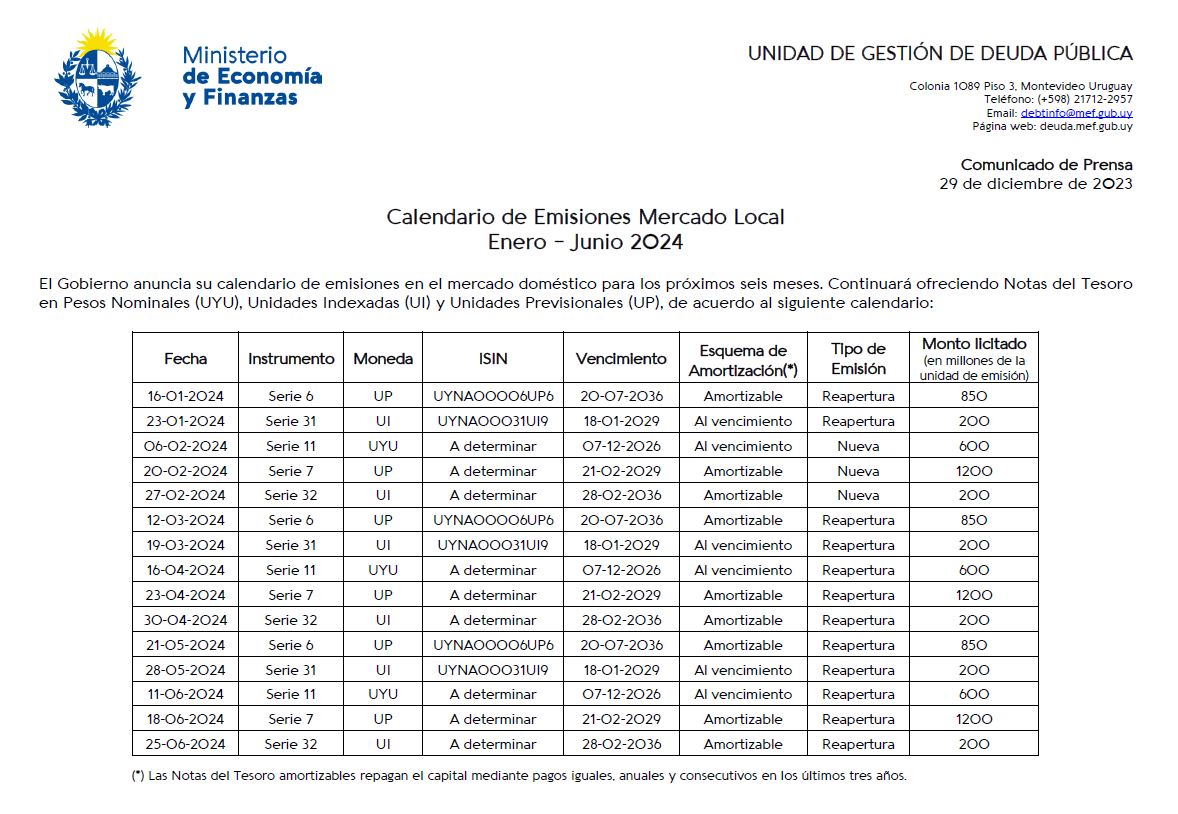

29 de diciembre de 2023. El Gobierno anuncia el calendario de emisiones en el mercado doméstico para los próximos 6 meses. Continuará licitando Notas del Tesoro en Pesos Nominales, Unidades Indexadas y Unidades Previsionales con diferentes plazos. Asimismo, se continuará dando la opción de utilizar Letras de Regulación Monetarias del Banco Central como títulos elegibles para canje, en ciertas licitaciones de Notas del calendario. Ver el detalle de de los términos y condiciones en el Comunicado de Prensa.

Acerca de la Unidad de Gestión de Deuda

La Unidad de Gestión de Deuda (UGD) fue creada en el ámbito del Ministerio de Economía y Finanzas del Uruguay con el objetivo de desarrollar una administración independiente de las obligaciones financieras y de los flujos de caja del Gobierno Central.