CPI-Linked

(denominated in UI)

UIs are inflation-indexed monetary units. The UI is calculated by the National Institute of Statistics (Instituto Nacional de Estadistica or INE) and is published monthly in advance for each day from the 6th day of a month to the 5th day of the following month. The UI is available on Bloomberg by typing “URUIURUI <INDEX> <GO>” (or “URUDUD <INDEX> <GO>”. The UI changes on a daily basis to reflect changes in the consumer price index (Indice de Precios al Consumo or IPC), which is measured by the INE. The UI for each day is set in advance based on changes in previous months’ inflation.

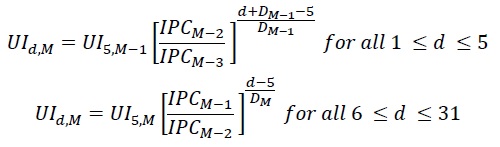

The UI is readjusted on a daily basis in accordance with the evolution of headline inflation (IPC) as determined by the following formula:

where UId,M corresponds to the value of the UI on day d and month M, DM corresponds to the number of days in month M, IPC M corresponds to the value of the IPC on month M and, in consequence, the coefficient between IPC M-1 and IPC M-2 corresponds to the inflation rate of the previous month. The index was created with an initial value of 1.0 on June 1st 2002 and was subsequently adjusted to 1.2841 on August 1st 2003.